Present value of perpetuity calculator

Future value is the balance an account will accrue over time. Equity Value 50000000.

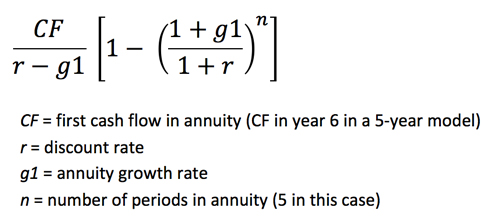

Present Value Of A Growing Annuity Formula With Calculator

Example of the Present Value of Growing Perpetuity Formula.

. Where is the number of terms and is the per period interest rate. The present value of an annuity is the current value of future payments from that annuity given a specified rate of return or discount rate. Where pmt is the regular payment per period.

In most cases well be using the GDP growth. PVPresent value of the perpetuity PmtPayment amount. Future Value FV.

The formula to calculate the present value of a perpetuity is. This p-value calculator helps you to quickly and easily calculate the right-tailed left-tailed or two-tailed p-values for a given z-score. Despite the lower number of shares the equity value for company B is higher.

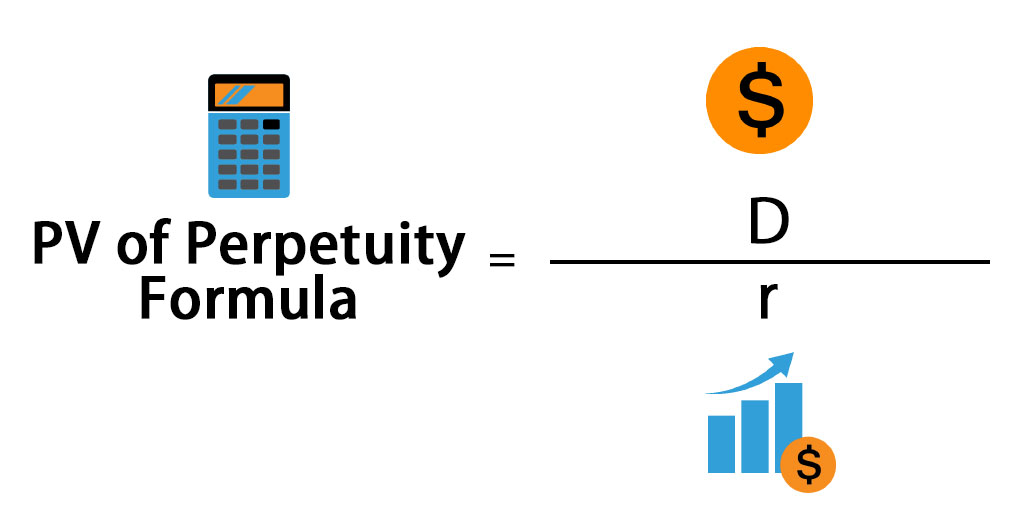

A perpetuity is defined as security eg bond with no fixed maturity date and the formula for calculating the present value PV of a perpetuity is equal to the cash flow value divided by the discount rate ie expected rate of return based on the risks associated with receiving the cash flows. 5000 it is better for Company Z to take Rs. Equity Value 500000000.

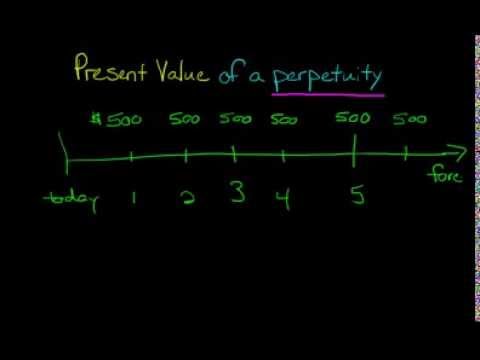

The present value calculator uses the following to find the present value PV of a future sum plus interest minus cash flow payments. The constant perpetuity and the interest. Present Value of a Perpetuity t and n mt For a perpetuity perpetual annuity the number of periods t goes to infinity therefore n goes to infinity.

The calculator processes your input automatically and shows you the present value of a perpetuity. Annuity formulas and derivations for present value based on PV PMTi 1-11in1iT including continuous compounding. In doing this the calculator will automatically generate the Present Value.

It also generates a normal curve and shades in the area that represents the p-value. The projected annuity the discount rate as well as a growth rate if applicable fill in 0 otherwise. The formulas are programmed into most financial calculators and.

Use the perpetuity calculator below to solve the formula. Firstly figure out the future cash flow which is denoted by CF. Step 3 Next determine the discount rate.

The present value of an annuity is the value of a stream of payments discounted by the interest rate to account for the fact that payments are being made at various moments in the future. Perpetuity Growth Rate Terminal Growth Rate Since horizon value is calculated by applying a constant annual growth rate to the cash flow of the forecast period the implied perpetuity growth rate is how much the free cash flow of the company grows until perpetuity with each forthcoming year. Present value of a perpetuity is an infinite and constant stream of identical cash flows.

Their returns are reflected in a residual value that equals the present value of the perpetuity discounted to the last year of the forecasts time horizon. After solving the amount expected to pay for this perpetuity would be 200. To calculate the PV of the perpetuity having discount rate and growth rate the following steps should be.

More Future Value of an Annuity. The perpetuity value formula is a simplified version of the present value formula of the future cash flows received per period. Equity Value of Company A.

The value of an asset or cash at a specified date in the future. The Present Value the Annual Interest Rate and the Payment. Delayed perpetuity is a perpetual stream of cash flows.

Present value is linear in the amount of payments therefore the. 5500 after two years is lower than Rs. The present value is given in actuarial notation by.

Present Value Therefore the present-day value of Johns lottery winning is. The present value is the total amount that a future amount of money is worth right now. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Present Value PV FV 1 r n. Present Value of a Perpetuity. This cash flow is expected to grow at 5 per year and the required return used for the discount rate is 10.

PV the Present Value FV the Future Value r the interest rate as a decimal n the number of periods. The present value or price of the perpetuity can also be written as. The Perpetuity Calculator Calculate the Present Value of a Perpetuity incl.

In the above example we observe that the equity value calculated by multiplying the shares outstanding by the share price for company B is higher than company A. Present value means todays value of the cash flow to be received at a future point of time and present value factor formula is a toolformula to calculate a present value of future cash flow. Residual Value Net Present Value perpetuity interest rate.

To get the Present Value input the payment amount which is a monetary value and the annual interest rate in percentage. Equity Value of Company B. Step 4 To arrive at the PV of the perpetuity divide the cash flows with the resulting value determined in step 3.

This is a special instance of a present value calculation where payments 0. The formula for the present value can be derived by using the following steps. Calculate the present value of an annuity due ordinary annuity growing annuities and annuities in perpetuity with optional compounding and payment frequency.

Present Value of Growing Perpetuity Year 1 Cash Flow Discount Rate Growth Rate Present Value PV of Perpetuity Excel Template. The calculation of this value requires 2 assumptions. Growth Rate Provide the requested values ie.

Rate is the interest rate per period as a decimal or a percentage. Present value is the amount of money needed to generate a specific return. Explanation of PV Factor Formula.

An example of the present value of a growing perpetuity formula would be an annual cash flow of 1000 that will continue indefinitely. To get started fill out the form below to access the Excel file. Now we can move on to an example present value PV calculation of perpetuities with varying growth rates.

Present value calculations are also very useful when it comes to bond yields and pensions as well as savings accounts. There are three values you can acquire from this perpetuity calculator. Perpetuity is a stream of equal payments that does not end.

The present value of a perpetuity formula can also be used to determine the interest rate charged and the size of the regular payment. Perpetuity Yield PY Present Value of Perpetuity PVP and Perpetuity Payment PP Calculator Present Value PV and Future Value FV Number of Periods Calculator Present Value PV Calculator. The solutions may be found using in most cases the formulas a financial calculator or a spreadsheet.

It is calculated as follows. Next decide the discounting rate. Present Value 96154 92456 88900 85480.

Get 247 customer support help when you place a homework help service order with us. Calculate the present value investment for a future value lump sum return based on a constant interest rate per period and compounding. As present value of Rs.

Pyramid Chart Showcasing Different Tiers Of Content Investment Per Account For Account Based Marketing Strat Marketing Guide Technology Solutions State Of Play

Perpetuity Formula Calculator With Excel Template

Introduction To Present Value Video Khan Academy

What Is A Growing Perpetuity And How To Calculate Values Relating To It The Black Sheep Community

Perpetuity Calculator Present Value Of Infinite Annuity Growth Rate Calculate Online

Present Value Of Growing Perpetuity Formula With Calculator

Pv Of Perpetuity Formula With Calculator

How To Model Multi Stage Terminal Values The Marquee Group

Pvgo Formula And Calculator Excel Template

Discount Rate Cost Of Capital Formula And Excel Calculator

What Is Present Value Pv

Perpetuity Concept In Financial Analysis Magnimetrics

Present Value Of A Perpetuity Youtube

How Do Companies Calculate Dividends Dividend Financial Strategies Budgeting Money

Present Value With Continuous Compounding Formula With Calculator

Time Value Of Money Formulas Infographic Covering Perpetuity Growing Perpetuity Annuity Growing Time Value Of Money Accounting And Finance Finance Investing

Hp 10bii Financial Calculator Npv Calculation Financial Calculator Calculator Graphing Calculator